Economy

Stock Markets Are Optimistic on Gains as The Fed Meet Wall Street Journal Print Subscription

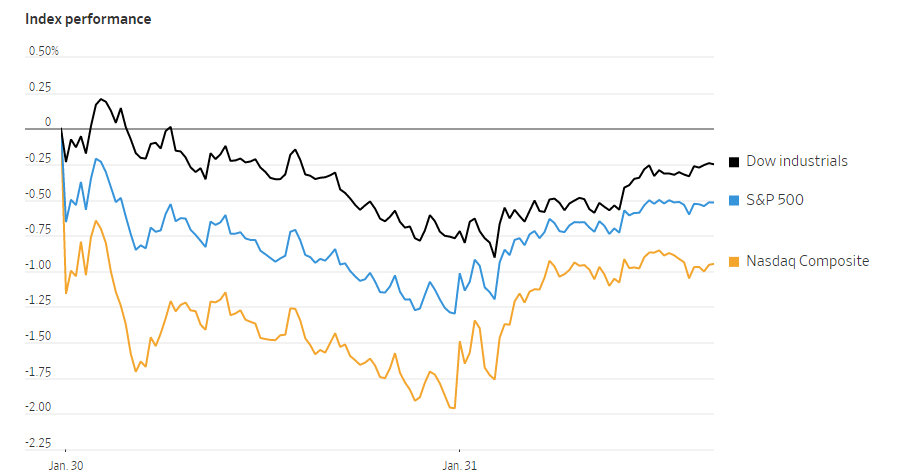

Investors are eager to parse the Federal Reserve’s statements at Wednesday’s meeting for hints at the future path of policy—the Fed is broadly expected to raise interest rates by a quarter percentage point. Tuesday morning data showing that wage gains are cooling buoyed hopes that waning inflation could prompt officials to pause rate increases in the months ahead.

Wall Street Journal Print Subscription

“With unemployment at 3.5% and the economy still adding more than 200,000 jobs per month, it’s way too premature to suggest that the Fed’s work is done,” Hans Olsen, a chief investment officer of Fiduciary Trust Company, reported to Wall Street Journal Print Subscription. “Investors’ expectations are getting a bit ahead of themselves; we’re in the early stages of normalizing inflation—the last 100 yards will be tough.”

Investor optimism is salient in derivatives markets. Wagers show the federal funds rate reaching 4.9% by June, with two rate cuts expected in the latter half of 2023. Volatility in Eurodollar options—used to bet where central bankers will take interest rates—slipped to its lowest level in roughly a year. That was before the Fed began upping the policy rate.

Meanwhile, central bankers have held the line on maintaining restrictive policy: Wall Street Journal Print Subscription reported Fed officials to expect rates to reach 5.1% and Chairman Jerome Powell has dismissed the possibility of cuts this year.

Get 5 Years of The WSJ and Economist and Save 77% Off

The market narrative is very much “goldilocks” at the moment, according to Mr. Olsen.

In bond markets, Treasurys have soared while yields have dropped to reflect Wall Street’s bets that rates are nearing their peak.

The yield on the benchmark 10-year Treasury note fell to 3.538% from 3.550% Monday, falling three-tenths of a percentage point this month. The two-year note yield—which is highly sensitive to monetary policy expectations, slipped to 4.220% from 4.259%. Its nearly 0.18 percentage point drop in January is the largest monthly decline since Covid-19 rattled markets in March 2020.