Real Estate

Rent Control Goes to a November Vote in Orlando as Rents Soar

A clash over the prospect of rent control in central Florida is heating up this month and will be closely followed across the U.S., as other cities consider ways to address record high rents.

The board of commissioners for Orange County, which includes Orlando, last week moved to put a measure on the November ballot to let voters decide whether to limit how much landlords can boost apartment rents.

While Orange County officials estimate that more than 100,000 households could be eligible for rent control, its passage faces significant challenges. Florida law mostly prohibits price controls on rent, unless Orange County can prove it is experiencing a housing emergency.

The first challenge to the rent-control vote came on Monday, when two real estate trade groups filed a lawsuit against Orange County. They said the ballot proposal violates state law and shouldn’t be put to voters.

Get 52 Weeks of The Wall Street Journal Print Edition for $318

“It is unfortunate that a majority of the Orange County Commission disregarded the law and instead moved to place this measure on the ballot,” said Amanda White, a spokeswoman for the Florida Apartment Association, one of the organizations suing the county.

A spokeswoman for Orange County said the county doesn’t comment on active litigation.

Orange County’s vote on rent control marks the latest effort by a city or local government to introduce measures that are outlawed or pre-empted in more than two dozen states. But with rents nationwide at all-time highs and climbing, and with progressive Democrats exerting more power in major cities, rent control is getting a fresh look.

California and Oregon have passed statewide measures over the past four years that peg maximum rent increases to inflation rates. Cities including St. Paul, Minn.; Portland, Maine; Kingston, N.Y. and Santa Ana, Calif., have passed their own rent controls since then.

Other legislative attempts have failed, however, including a bill in New York to cap rents statewide, and a bill in Colorado limiting ground rent increases for mobile homes.

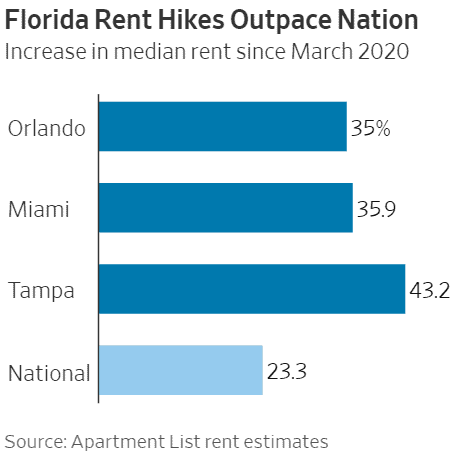

Orlando rents have risen 35% since March 2020, according to listings website Apartment List, by far the fastest rate recorded for the city and among the biggest increases in the U.S.

Subscribe to Bloomberg Digital for $89

The Orange County rent measure would expire after one year, and voters would have to vote again to renew it. The proposed law would set a maximum increase of no more than the regional change in the Consumer Price Index, which rose 9.4% during the 12 months ended in July.

Officials who support it say the measure would ease the toll of housing inflation on renters, while lawmakers work on other policies to increase new housing supply.

“It gives us a chance to pump the brakes,” Nicole Wilson, one of the commissioners in favor of the rent control, said during a board meeting last week.

The real-estate industry and some lawmakers argue that rent control will lead to less property investment and lower rates of construction in the Orlando area.

Florida cities, which saw more inbound migration than most during the pandemic, have experienced some of the country’s steepest hikes. Rents in Tampa and Miami have risen more than 30%, and officials there might be emboldened to follow Orange County’s lead if its rent control effort succeeds.

Since 1977, the state of Florida has banned local governments from controlling the price of rent, unless the housing market has become so strained that it becomes “a serious menace to the general public,” according to state law.

Officials in Tampa, St. Petersburg and Miami have debated the issue over the past year, but only the Orange County government has decided to put the matter on the public ballot.

Rent control in Orange County would apply only to multifamily buildings. It would exempt owners of single-family properties, which have also enjoyed unusually high rent increases during the pandemic. Landlords could request exceptions from the rent cap because of increased operating or maintenance costs.

Get Barron’s Digital News 5-Years Subscription for $69

The proposal would spare newly constructed rental properties, though even that carve-out might not be enough to win over certain builders who oppose such policies.

“Camden will not build in a rent-control market,” said Ric Campo, chief executive of Camden Property Trust, a publicly traded developer and landlord that owns 4,000 units in Orlando.

In the three months after the rent-control law passed in St. Paul, new building permit applications dropped more than 80% annually, according to an analysis of public records by the Pioneer Press newspaper. St. Paul officials have since proposed omitting new buildings.

Emily Bonilla, a commissioner in Orange County who supported the rent-control proposal, said new construction would continue. Unlike the rent-control measure in St. Paul, she said, Orange County’s law wouldn’t regulate rent increases at new buildings.

She added that the ordinance would protect vulnerable people, such as those who work in hospitality or at theme parks and face potential rent increases equaling hundreds of dollars each month. Some of these workers have already ended up living in extended stay hotels, she said.

“A lot of these families, their rents are raised on them, they weren’t able to pay it and then they were evicted,” she said. “And now they can’t qualify for a place to live.”